bank of canada prime rate

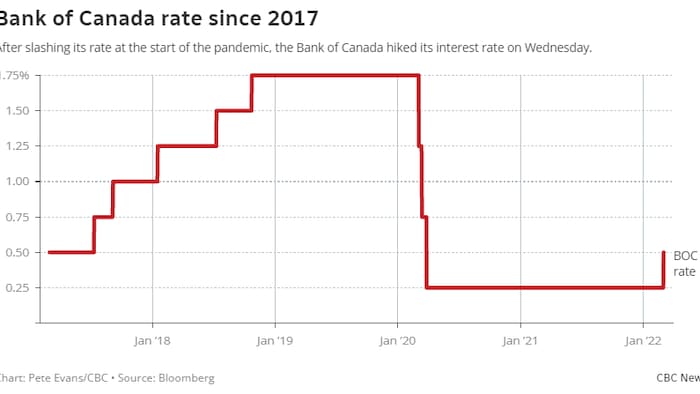

The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada. The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages.

Success Story Of Netflix Services Netflix Netflix Service Netflix International

1 day agoThe increase in the prime rate which variable-rate mortgages are tied to will take effect on Thursday the lender said.

. From 2023 onwards the outlook is less certain and highly dependent on global macroeconomic factors. National Bank sees interest rates doing a steep climb this year and they expect it to start within weeks. By Staff The Canadian Press Posted March 2 2022 405 pm.

MONTREAL March 02 2022 GLOBE NEWSWIRE -- Laurentian Bank of Canada TSX. Bank of Canada Interest Rate Forecast for the Next 5 Years. Bank of Canada Interest Rates.

We are not a commercial bank and do not offer banking services to the public. TORONTO Reuters Royal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on. This is lower than the long term average of 724.

This would bring the overnight rate to 050 double the current level. Typically prime rate moves in lock-step with the Bank of Canadas overnight rate but not always. The Bank of Canada is the nations central bank.

Above we have predicted that the Bank of Canadas Target Overnight Rate will remain at 025 for 2021 and rise to 050 in 2022. 1 day agoRoyal Bank of Canada Toronto-Dominion Bank and Bank of Montreal said on Wednesday they will raise their prime lending rates for the first time since October 2018 after the Bank of Canadahiked. 1 day agoFollowing a change to the overnight target rate the big banks and other financial institutions will then announce changes to their prime rate in the coming days.

The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. Bank of Canada Interest Rate Announcement January 26 2022 James Orlando CFA Senior Economist 416-413-3180. The Bank of Canada is keeping its key interest rate target on hold at 025 per cent but warning it wont stay there for much longer.

We researched it for you. 1 day agoBy Nichola Saminather. The central banks overnight interest rate sets the tone for the prime rates offered by banks.

Prime Rate Advertising Disclosure. In total the bank has forecast five interest rate hikes in 2022. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada.

2009 Longest period of no change. Canada Prime Rate is at 245 compared to 245 last week and 245 last year. 1 day agoRBC TD first banks to hike prime interest rate after Bank of Canada decision.

Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. 11 hours agoRBC TD and BMO lift prime rates to 27 after Bank of Canada hike Back to video The higher prime rate which variable-rate mortgages are tied to will rise to 27 per cent from 245 per cent and come into effect on Thursday the three lenders said. Find Out What You Need To Know - See for Yourself Now.

1 day agoThe Bank of Canada raised its key interest rate target for the first time since slashing its benchmark rate to its rock-bottom level at the start of the COVID-19 pandemic. Updated April 23rd 2021. The prime rate in Canada is currently 245.

Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. We explain what changes in the policy rate mean for you.

The Bank of Canada which sets the country. 1 day agoThe Bank of Canada cut its key interest rate to the emergency level of 025 in March 2020 in an effort to help the economy weather the economic shock of the pandemic. LB increases its prime lending rate by 25 basis points from 245 to 270 effective March 3 2022.

Since then the economy has. In 2008 and 2015 the banks didnt pass along the full extent of BoC rate cuts. 2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018.

The Bank of Canada. In the first quarter the Bank of Canada BoC is forecast to raise rates by 25 basis points bps. Ad Prime Interest Rate Today Interest Rate Mortgage Rates Interest Rates.

1 day agoBank of Canada likely to hike key interest rate Wednesday The Bank of Canada is expected to boost its trendsetting policy rate which has been parked at.

Pin On Fxnice

U S Investor Optimism Rises Again Hits 17 Year High Strong Hand Optimism Optimistic

The Omnipresent Future Of Ecb Unconventional Monetary Policy Is Here May 19th 2018 Monetary Policy Omnipresent Policies

/fredgraph-6da2f6d034614be89a641e5e5df9ee4d.jpg)

How The Fed Funds Rate Hikes Affect The Us Dollar

Pin On Economy

Pin En Area De Toronto Canada Familia

If Words Like Prime Rate Home Equity Line Of Credit Or Variable Mortgage Rate Aren T In Your Day To Day Vocab Mortgage Rates Mortgage Refinance Mortgage

Pin On Figuras 3d

Gbpusd Has The Primary Double Zigzag Ended Orbex Forex Trading Blog Forex Trading Pattern Forex

Pin On The Big Picture

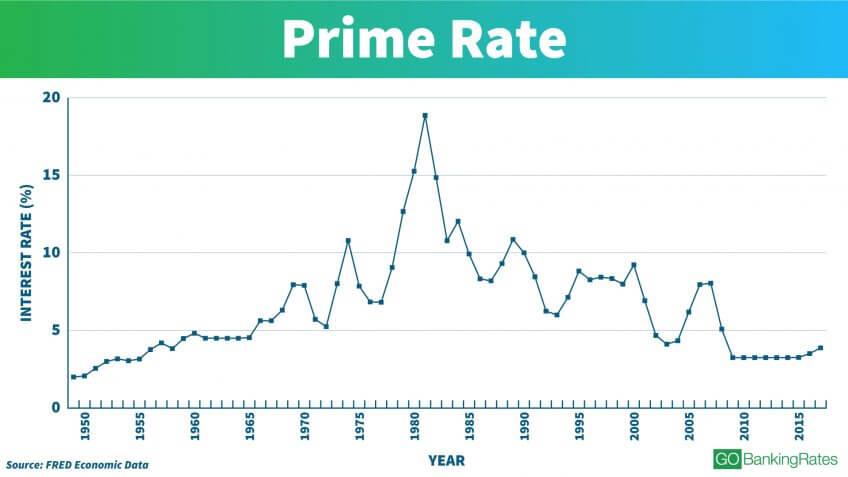

See Interest Rates Over The Last 100 Years Gobankingrates

7mri6 94t8ffom

:max_bytes(150000):strip_icc()/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Federal Funds Prime And Libor Rates Definition

One Three Five Year Fixed Mortgage Rate Mortgage Interest Rates Fixed Mortgage Mortgage Rates